Categories

Popular Tags

A Beginner Guide to Mortgages in Dubai for First-time Homebuyers

The process of purchasing a home in Dubai can be very challenging for some first purchasers. The fact that this is their initial time and they are unfamiliar with the home-search and purchasing procedure is obviously the main factor. As a result, people are more likely to make costly errors while making regular home purchases.

Here is a road map for you if you’re a first-time mortgage buyer in Dubai and wish to get the procedure as simple and clear as possible.

Create a budget and organize your finances

Several steps are required in making any purchase, including purchasing a home, always requiring implementing a budget and making financial arrangements. In fact, since it will be among your biggest purchases ever, you should budget for it far more carefully.

You should think about a variety of factors while choosing a budget, including:

- Your financial capability

- Monthly salary

- Savings, among other things

Make sure to undertake considerable market research before doing this. Find out how much the type of home you seek in Dubai is currently selling for. Look at prices in particular places, such as if you’re searching for mansions for purchase in Dubai. This can help you choose how much cash to set aside.

Organize your resources after that. Certain parts of Dubai are noted for having costly real estate costs. As a result, it’s highly likely that you’ll need financial support, such a loan from either a bank or a lending company. Your current employment condition and creditworthiness are two factors that affect how much money you get.

Make sure you have a solid credit score before you apply for a mortgage. If not, there is a strong possibility that your loan application will be denied.

Relevant: 6 Tips for Getting a Bank Loan to Buy a House in Dubai

Complete a Project

This is a crucial stage that shouldn’t be overlooked. Whether you want to live in the house that you are going to buy or rent it out, your decision will affect the project’s completion. If it’s the former, you’ll need to pick from one of Dubai’s finest districts, that is well-connected, offers a peaceful lifestyle, and has every amenity within walking distance. It can be evidently said that the costing is a crucial factor that affects the project completion

There are a number of things to think about when purchasing something as an investment, with the payback ranking as the most crucial one. It suffices to say that the residence should be situated in a region with a high potential for capital appreciation. Ideally, the area with the most visitors.

Relevant: 10 Tips to Know Before Buy Property in Dubai

Keep yourself aware with the Market price

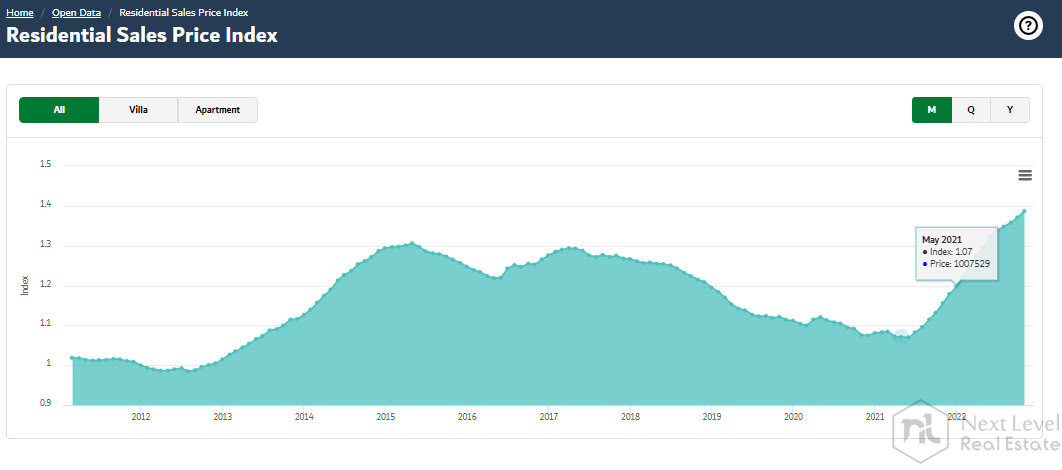

Residential Properties Price Index

Make sure you are aware of the market pricing and the anticipated rental return if you are planning to purchase Dubai real estate as an investment.

Pick a location that advances your objective. Invest in real estate in well-known areas with strong demand from renters, such as Dubai Marina, if you want to see a solid return on your money.

Relevant: List of benefits of owning a rental property?

Make a list of the key components you would like in your house.

The next stage is to decide exactly what sort of home you want once your budget and the neighborhood have been worked out. You can search for condos, townhomes, duplexes, houses, and apartments for purchase in Uae based on your requirements and financial constraints.

But keep in mind that not all apartments or villas in Dubai are the same. They vary in terms of their architecture, plans, areas covered, and amenities offered. As a consequence, you ought to make a list of everything you need in your house. This should include factors such as the variety of bedroom, as well as details on the terrace, balcony, yard, patio, pool, and window views.

The process will go more smoothly for you if you are clear about what you want, and your realtor will be able to provide you with the appropriate listings that meet your requirements.

Relevant: Dubai’s Best Neighborhoods For Families To Thrive

Decide whatever you want to purchase.

Which would you choose—a house or an apartment? Do you prefer living in the city or next to the water? Are restaurants, retail centers, public transportation, and schools all equally important to you? You may make wise judgments when buying Dubai real estate by providing answers to certain questions

Relevant: All about Emaar Beachfront Waterfront Projects

Search for a reputable developer with local knowledge.

Finding a real estate agent with extensive local knowledge is crucial because each region and community has its own special issues. Work with a person who has a history of selling homes in the neighborhood where you want to buy because they will be familiar with the region and can help you negotiate the best price.

Service fees for maintaining common areas like gyms, parks, swimming pools, as well as other common spaces will either be fixed at a certain amount or vary based on the number & area of the site.

If you choose to purchase a large home, this may be a significant expense. Find out how much a property similar to theirs typically costs in terms of water and electricity (DEWA). Examples of supplemental expenses include service charges and mortgage registration expenses.

Relevant: How to reduce DEWA bill in Dubai?

Thoroughly comprehend the purchasing procedure

There are three ways to buy real estate in Dubai: off plan properties from a builder, a ready to move in property from a developer, or from a private seller on the secondary market. Expats must supply a completed registration form, a passport, and a reserve fee when buying homes directly from the builder, whether they are off the plan or ready.

Relevant: Can Expats Buy OFF Plan Property on Mortgage in Dubai?

If you are acquiring a resale property, a Memorandum of Intent must be signed by you and the seller. The agreed-upon deposit will be requested from you, the buyer. After receiving financing, titles will officially transfer.

The Wrap Up

Just a few of the new regulations that have lately been established include those that restrict mortgages, offer programmes for off-plan house purchases, and charge transfer and processing fees. Keep up with the latest regulations to make informed judgements while acquiring real estate in Dubai.

Relevant:

- How to Secure a Mortgage in Dubai for Expats?

- Expert Guide of Tenancy Contract Between Broker & Buyer in Dubai?

- Is Getting a Mortgage When Purchasing a Home in Dubai a Good Idea?

Feature Properties

You Might Also Like

Stay in the loop Through our newsletter

Get to know about the latest real estate insights.

Popular Searches

Off Plan Projects

Popular Areas

About Us

Popular Searches

Off Plan Projects

Popular Areas

Next Level © 2026 All Right Reserved