Categories

Popular Tags

Dubai Real Estate Continues Growth Momentum With Record Transactions

Dubai’s residential rents and sales reached records at the year’s conclusion. Last month, CBRE reported that Dubai’s real estate deals climbed by 63% to 8,662, with off-plan sales (92.5%) and secondary market transactions (35.4%) leading the way. In 2022, the emirate sold 90,800 homes, topping the 2009 record by 1,182. In December 2022, CBRE’s Dubai Residential Market Snapshot reported 9.5% average property price growth, with flats up 9% and villas up 12.8%. Dubai’s average apartment price in December was Dh1,168, while the average villa price was Dh1,385. Average apartment and villa rates are 21.5% and 4.2% below the 2014 high, respectively. According to the data, Jumeirah has the highest sales rate per square foot at Dh2,324 for flats, while Palm Jumeirah has the most at Dh3,921 for villas.

Renting Industry

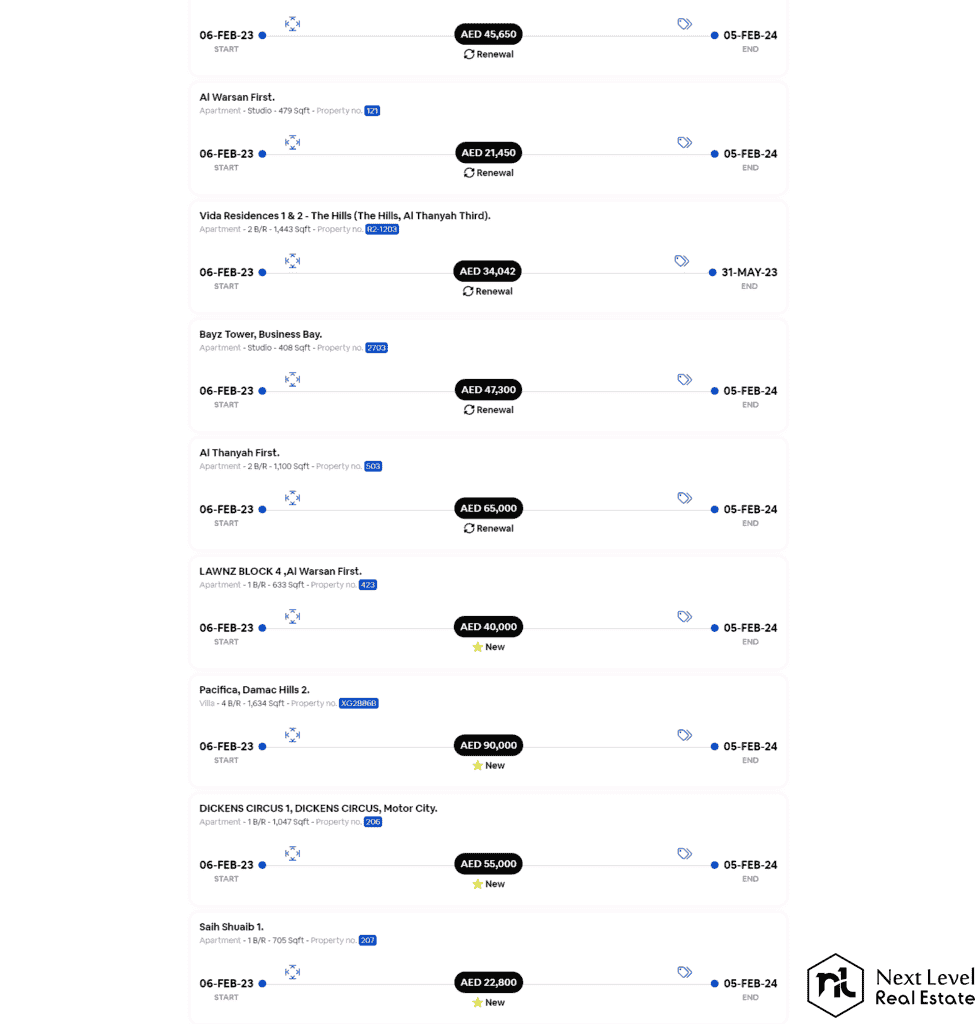

Average rentals in Dubai rose by 26.9 percent between December 2021 and December 2022, reflecting the city’s overall upward pricing trend. Rental costs for apartments and villas rose by 27.1% and 24.9%, respectively, over this time frame. Apartments had yearly median rentals of Dh95,168 as of December 2022, while estates had median rents of Dh282,150. Apartments in Palm Jumeirah have the highest average annual rentals, at Dh248,452. In contrast, according to the report, villa rents have reached an average of Dh1,016,956.

Foreign Direct Investment

International investors, progressive corporate improvements, and visa-related measures will boost UAE real estate. Real estate will benefit. However, global turbulence, to which the UAE is not immune, predicts a period of exuberance followed by a decline. The advisory group said the emirate and UAE showed “exceptional resilience” throughout last year’s pandemic. Due to the economic recovery, increased oil prices, and a tourist and commerce boom, international investment and transactions skyrocketed. Last year, Dubai delivered 27,000 apartments and 4,000 villas. Last year’s unit count was impressive, given the global economic downturn and supply-chain bottlenecks. At the end of 2022, the emirate started more new projects, and apartment and villa rental costs rose. The annual rental rise in the villa sector was 23%, while gains in flats and offices were 19%.

The Case for Complete Disclosiveness in the Real Estate Market

The multinational real estate consultant JLL has identified the real estate markets in Dubai and Abu Dhabi as two of the world’s best performers in 2022. The real estate market in Dubai is the most transparent in the Middle East and North Africa, according to JLL’s Global Real Estate Transparency Index (GRETI) (MENA). Only one other property market in the Middle East and North Africa region makes the ‘transparent’ tier, but it’s different from the emirate.

Several initiatives contributed to Dubai’s rise to prominence.

- New commercial and residential sales and rental indexes get introduced.

- Improvements to digital services and the REST platform

- The creation of a record of beneficial ownership

- The introduction of new rules governing market lending practices

- Disclosures about the environmental impact

Highest-Ranking and Most-Selling Areas

During the first six months of the year, the apartment market saw 5,880 sales for AED 10.9 billion, while the villa market saw almost 2,000 transactions worth AED 7 billion. From a transactional standpoint, THE VALLEY (with 960), Al Hebiah Fourth (with 961), and THE FIELD (with 962) are the three most-selling and considerably prosperous areas.

Gulf News: Dubai property nets Dh10 billion in first 10 days of 2023

Is 2023 going to be a breakout year for the Dubai and Abu Dhabi real estate markets?

Dubai and Abu Dhabi will enhance 2022 UAE real estate sales. Expo 2020 Dubai and Qatar’s 2022 FIFA World Cup improved Dubai’s real estate market. Once Savills ranks Dubai first in branded apartments. Due to solid tourism, hospitality, real estate, transportation, and industrial sectors, the UAE Central Bank boosted its 2022 economic growth prediction to 7.6 percent from 7.2 percent. Rising interest rates, asset value fluctuations, and housing market crisis fears affected 2022 worldwide real estate activity. Due to a supply or demand mismatch, Knight Frank expects Dubai’s primary sector prices to jump 50% by 2022. The World Bank predicts UAE GDP growth of over 4 percent in 2023.

Relevant:

Feature Properties

You Might Also Like

Stay in the loop Through our newsletter

Get to know about the latest real estate insights.

Popular Searches

Off Plan Projects

Popular Areas

About Us

Popular Searches

Off Plan Projects

Popular Areas

Next Level © 2026 All Right Reserved